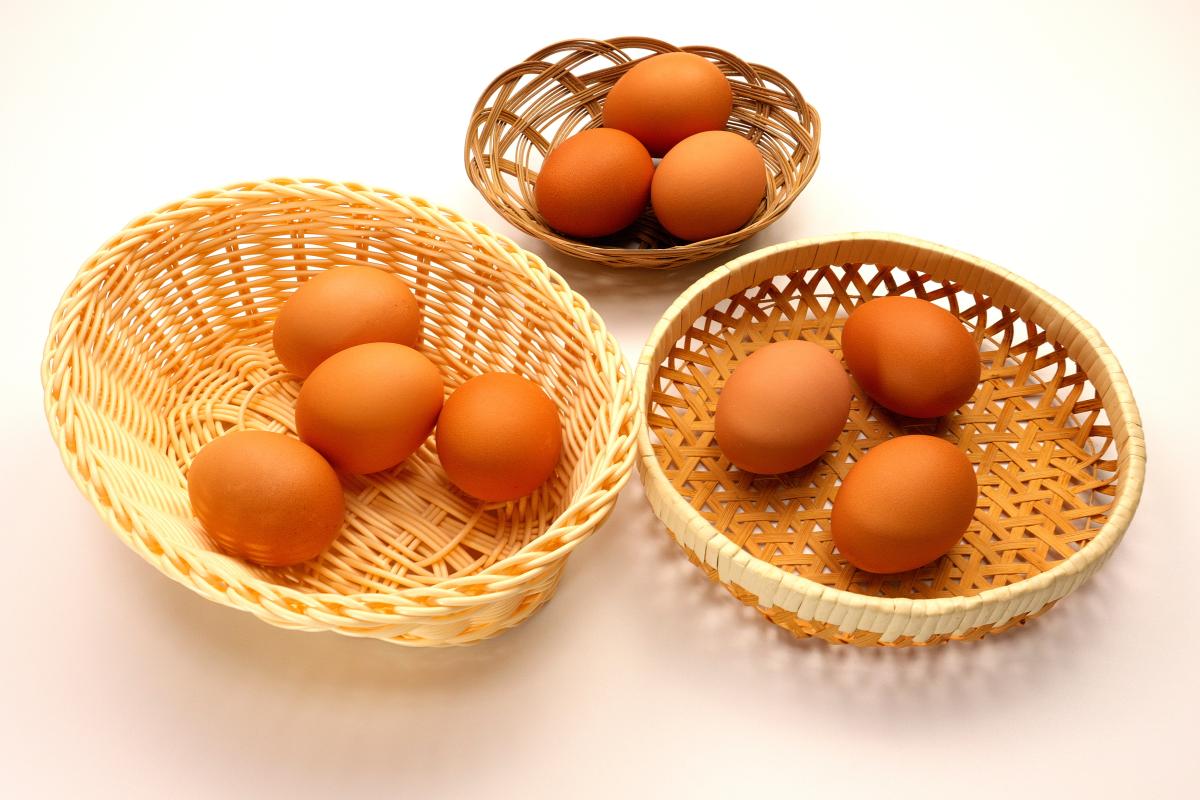

For decades, investment professionals have advised their clients to embrace the practice of diversifying their investment portfolios. It’s a philosophy of not putting too many eggs in one basket, lest something happen to that basket. It’s also a belief in having exposure to all areas of the economy, each of which will wax and wane over time. Additionally, it is an acknowledgment that no one knows for certain how any company or sector of companies will perform.

For decades, investment professionals have advised their clients to embrace the practice of diversifying their investment portfolios. It’s a philosophy of not putting too many eggs in one basket, lest something happen to that basket. It’s also a belief in having exposure to all areas of the economy, each of which will wax and wane over time. Additionally, it is an acknowledgment that no one knows for certain how any company or sector of companies will perform.

Times like the present can test an investor’s commitment to that practice as sectors like technology seem to continue to outperform the broad market. Then there is Invidia, the AI juggernaut that beat all comers out of the gate in Artificial Intelligence. And who would not want a large dose of Bitcoin, which recently traded over $100,000? It’s tempting to throw caution to the wind and put everything into a handful of the largest tech companies and round out your portfolio with some sexy cryptocurrency. That strategy might work until it doesn’t.

Markets and sectors go in cycles, back and forth like a clock’s pendulum, but usually in an upward direction over a long period of time. Sectors or companies often get hot and attract speculators who are looking to make a quick buck. Sometimes securities go up simply because people are buying them and the more they increase, the more attention they attract perpetuating the cycle until something changes. When the momentum cools, speculators will sell, and the fall can be as spectacular as the rise. That is not to discredit the underlying fundamentals of any company or sector, but speculative momentum can push companies to excessive valuations.

So, how to know if you are properly diversified? First, if properly diversified, your portfolio will always under-perform the best performing companies and sectors, and it will always out-perform the least performing companies and sectors. Another way to know that you are properly diversified is that you never own enough of anything to make a killing, nor be killed by it. It’s moderation at its finest. Disciplined investors know the difference between investing and speculating. They have learned to block out the noise and rest, confident that over time their broadly diversified holdings will appreciate in line with the growth of the underlying companies’ revenue, earnings and dividends. They don’t need to constantly search for the next big thing, because if they are properly diversified, they probably already own it, just in moderation.

Keep a cool head.

Sam Taylor, CIMA®, AIF®, CRPC®

Wealthview Capital, LLC