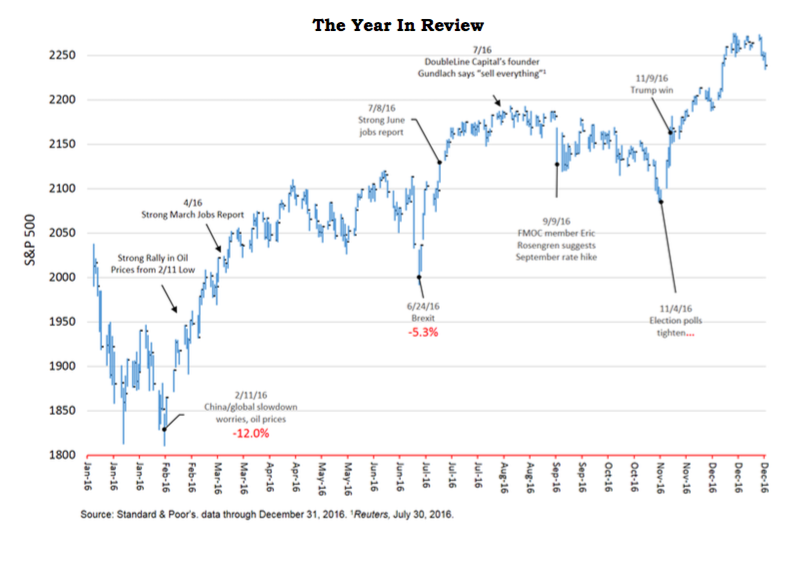

What an incredible year 2016 was in many ways. It began abysmally with the stock market experiencing its worst sell-off since the 1929 Great Depression and ended the year blowing out new all-time highs in the aftermath of the Presidential election. If there has ever been a case to avoid market timing and stay the course, 2016 was it. Unfortunately, many investors bailed out after the early-year losses, unwilling to expose their portfolios to potential further erosion. Some acted on the advice of so-called “smart money” experts, most of whom could not accurately predict the timing or frequency of the Federal Reserve’s interest rate increases, much less what the markets will do from year to year. While others halted their monthly savings programs to wait until after the election, as if their caution would somehow better position them to benefit from the outcome and subsequent market response. If only it was so easy. Markets react a lot faster than you can and by either predicting future events or waiting for confirmation of anything political or economic you risk making a big mistake.

After the afore-mentioned sell-off, the broad market bottomed out in mid-February, began building a base and then rallied over the next two months on stronger economic data and a rebound in oil prices which sent stocks back to the year’s earlier highs. It then traded sideways for the next two months until another sell-off in the aftermath of the unexpected Brexit vote. The down draft was brief as strong June and July jobs reports and record low interest rates resulted in a breakout to new all-time highs in August and September. The bears just couldn’t stand the prosperity and sold stocks when FOMC (Federal Open Market Committee) member Eric Rosengren talked up another interest rate hike. However, softer economic data followed and the data-dependent Fed decided to wait for more data which sent stocks soaring yet once again. And then came the election.

To the surprise of almost every financial and political pundit, Donald J. Trump was elected the 45th President of the United States and the Republicans held the house and senate. This consolidation of power under one party that is expected to cut taxes, increase infrastructure & defense spending, reduce regulations and expatriate the trillions of dollars frozen overseas by multi-national U.S. companies removed much of the uncertainty that had been plaguing the market. The result was a blow out of its previous highs with the Dow Jones Industrial Average almost hitting 20,000. Now comes the hard part.

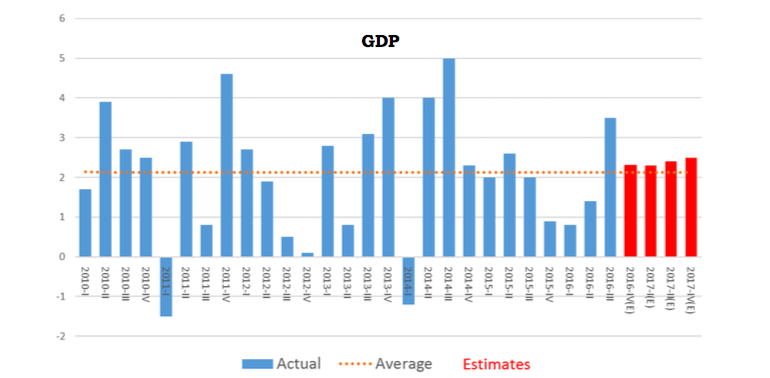

It would not be surprising to see the markets experience a post-inaugural hang-over as the difficulty in implementing these ideas may not be as quick and easy as some investors hope. Lower taxes and increased spending by the government could result in higher deficits, interest rates and inflation. Additionally, Trumps’ protectionist tendencies could invite retaliation from our overseas trading partners. However, if American businesses can operate in a lower-cost, less regulated environment the eventual results could be a new era of higher growth rates. Consumers finding more money in their pockets because of lower income tax rates will probably spend it. Since consumer spending represents about 70% of our GDP (gross domestic product) a small increase in discretionary income can make a big difference in economic growth.

The economy picked up steam in the 3rd quarter’s final reading of GDP which came in at an inflation adjusted annual rate of 3.5% as compared to 0.8% and 1.4% for the year’s 1st and 2nd quarter, respectively. From the time the recession ended in June, 2009 our economy has experienced the slowest recovery since 1949, growing at about 2.1% annually. Although the current 2017 consensus forecast is for growth of only 2.3%, we are overdue for a breakout on the upside.

Stocks

As mentioned previously, 2016 was a crazy year for the equity markets. Investors in U.S. companies were rewarded with double-digit gains ranging from a barn-busting 26.56% from small-cap companies (S&P 600) to a respectable 11.96% from larger firms (S&P 500). Small and medium-sized companies out-performed their larger brethren because they are thought to be able to grow faster in an expanding economy and because they are less exposed to the potential risks of a trade war; one of the concerns of a Trump presidency. For the year’s final quarter the relationship was the same with small and medium stocks out-preforming larger stocks. International markets suffered losses during 4Q-16 due to the concerns over trade, but for the full year, both developed (MSCI EAFE) and emerging (MSCI EM) markets posted gains, albeit widely different.

Bonds

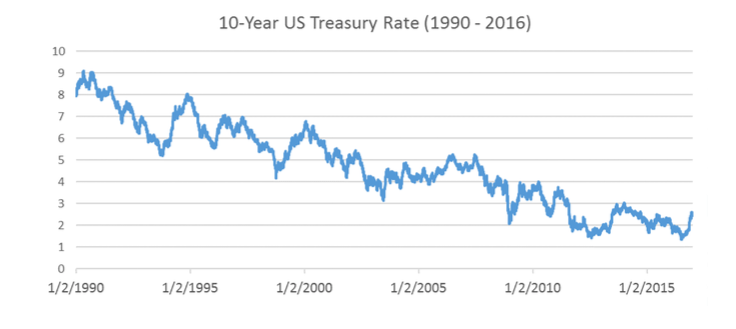

Bonds

Interest rates reversed a three-decade downtrend in 2016 as the 10-year U.S. Treasury bounced off its summer low of 1.36%, almost doubling in yield to 2.60% in just six months. A major sell-off in bond prices followed the Presidential election as the market obviously believes Trump/Republican policies will lead to higher interest rates and/or inflation. Always the follower, but never a leader, the data dependent Fed finally raised interest rates a paltry ¼ point for the first time this year on December 14th and just the second time in this economic cycle, but nowhere close to the consensus forecast which called for three rate increases for 2016.

During 4Q-16 our bond benchmark, the Bloomberg Barclays 1-5 Year Government/Credit, lost -1.05% and longer bonds fared worse. Remember, when interest rates rise, bond prices fall. For the full year 2016, our bond benchmark gained 1.56%. Our fixed-income strategy has been to maintain a short-duration bond portfolio to preserve capital, foregoing the potentially higher yields of longer bonds but which are subject to greater interest rate risk. We prefer to take our risks in the equities markets, not in bonds. However, should interest rates rise significantly, we will consider extending our maturities.

Going into 2017

This past year has been a case study in how difficult it is to predict anything and even more so, to construct an investment strategy based on those predictions, and why such efforts should be avoided. Wealthview Capital’s investment philosophy and resulting strategies are built upon this premise of unpredictability. As tempting as it may be, we fight constantly the urge to tilt our portfolios heavily in one direction or another, or to actively trade, chasing supposedly undervalued opportunities but which incur higher costs, higher taxes, greater risks and, very likely, lower net returns. We also totally reject market timing which can lead to huge bets that can put you on the wrong side of the market.

We also quietly resist the constant suggestions we receive to succumb to the herd mentality or buy into the latest fads. “What about technology or financials or dividend achievers? Aren’t those going to be the places to be this year? What about momentum investing? What about a strategy to anticipate a favorable Democratic or Republican election outcome? What about the impact from rising interest rates? What about generating more income in this income-starved environment? What about gold?” As you can see it never ends. There is literally no limit to the number of ideas you can pursue and at the end of the day if you buy into to this whack-a-mole mindset you will remain in a constant state of “investment anxiety” and risk never gaining a foothold on meaningful wealth creation.

The confidence needed to stay the course in equities through volatile climates like 2016 comes from an understanding of, and belief in what your portfolio represents. If properly diversified, you are already in possession of a vast collection of the greatest companies that ever existed in the history of the world. These are the firms that create and deliver the world-class products and services that make our standard of living greater than any prior generation and which produce the continuing growth in our economies. Constantly trading between them (looking for an edge) or periodically selling out completely (market timing) is an indication of a lack of understanding of, or conviction in the true merits of long-term equity ownership.

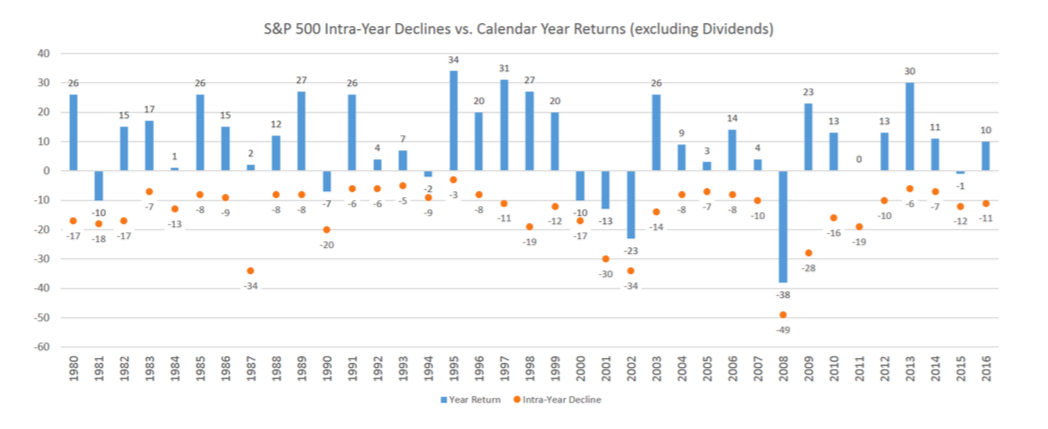

As illustrated in the chart to the left, the stock market is volatile and you should expect to see a downturn in your portfolio every year for one reason or another. However, a sell off is not the same thing as a loss and those who try to avoid these downdrafts, through market-timing or avoiding equity ownership altogether, will almost certainly rue the day they chose short-term stability over long-term wealth creation.

Financial wealth is not easily attained but the result of many factors, some of which include aggressive saving, prudent investing and intelligent planning. Wealthview Capital remains committed to these principals and to those families who partner with us in the prudent navigation of their life’s financial journey. We do not take our stewardship role lightly and look forward to 2017.