In the blink of an eye, events during the year’s first quarter turned the banking industry upside down, revealed new risks, added a layer of complexity to the Federal Reserve’s monetary policy decisions and created more questions than answers for bank depositors and investors alike. It also demonstrated once again how unpredictable these market moving events can be, validating the tried-and-true, albeit boring, practice of proper diversification. The highest inflation in 40 years led to the most aggressive monetary policy in 40 years which led to the 2nd and 3rd largest bank failures in US history which led to the bailout of uninsured customer deposits which left everyone dazed and confused.

Overall, equity markets held up well in 1Q-23 despite the turmoil within the banking sector as investors focused on the continuing growth of the economy, corporate earnings, and dividends as well as inflation that appears to be on the downtrend. The consensus estimate for S&P 500 earnings is for a flattening this year followed by a reacceleration in 2024. However, the huge money supply from the pandemic programs is falling as consumers increasingly dip into savings to maintain their standard of living. This could eventually represent a drag on growth and earnings. Equity valuations, as measured by P/E (Price/Earnings) ratios, appear around average for large companies and below average for mid and small companies. Bank stocks suffered significant declines in the first quarter as shareholders decided to sell first and ask questions later. As examples, KBWB, an ETF that tracks 24 of the nation’s largest banks, fell in price (excluding dividends) by -18.69% during the quarter and KRE, an ETF that tracks regional banks dropped -25.33%. By comparison, broadly diversified indices of large (S&P 500), medium (S&P 400) and small (S&P 600) U.S. companies gained (incuding dividends) 7.50%, 3.81%, and 2.57% respectively in 1Q-23.

Overall, equity markets held up well in 1Q-23 despite the turmoil within the banking sector as investors focused on the continuing growth of the economy, corporate earnings, and dividends as well as inflation that appears to be on the downtrend. The consensus estimate for S&P 500 earnings is for a flattening this year followed by a reacceleration in 2024. However, the huge money supply from the pandemic programs is falling as consumers increasingly dip into savings to maintain their standard of living. This could eventually represent a drag on growth and earnings. Equity valuations, as measured by P/E (Price/Earnings) ratios, appear around average for large companies and below average for mid and small companies. Bank stocks suffered significant declines in the first quarter as shareholders decided to sell first and ask questions later. As examples, KBWB, an ETF that tracks 24 of the nation’s largest banks, fell in price (excluding dividends) by -18.69% during the quarter and KRE, an ETF that tracks regional banks dropped -25.33%. By comparison, broadly diversified indices of large (S&P 500), medium (S&P 400) and small (S&P 600) U.S. companies gained (incuding dividends) 7.50%, 3.81%, and 2.57% respectively in 1Q-23.

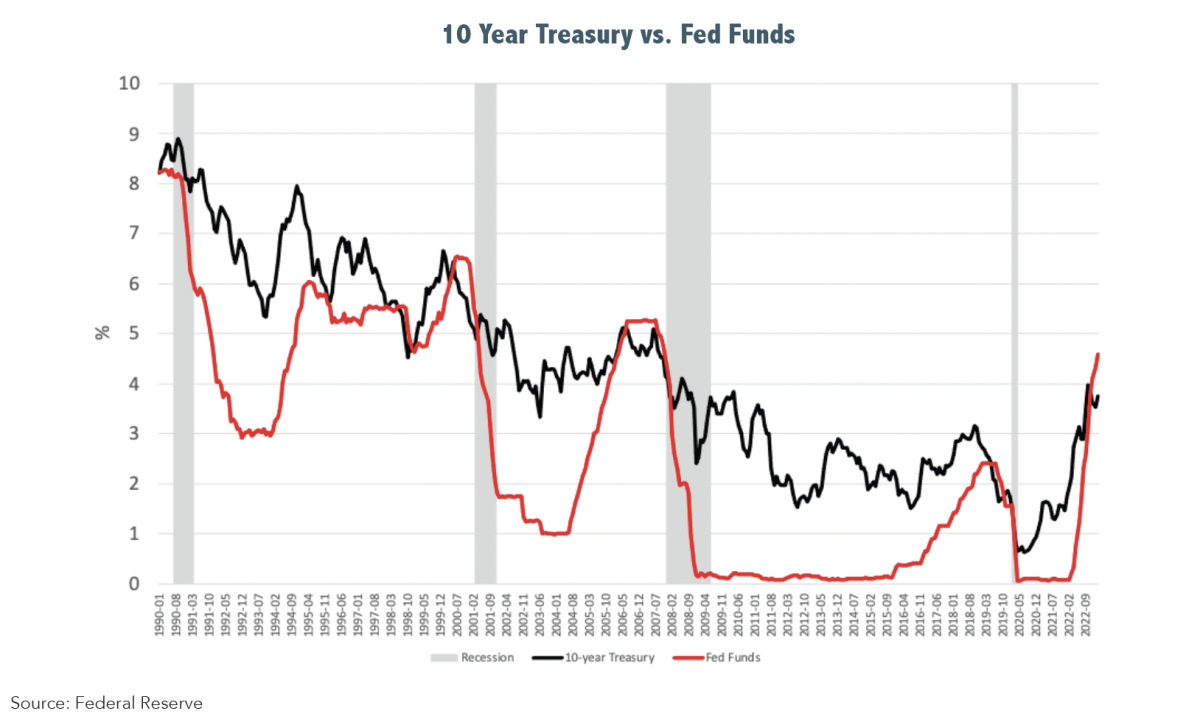

The FOMC (Federal Open Market Committee) raised the fed funds rate another ¼ point on March 22nd to a range of 4.75% - 5.00%, marking the ninth consecutive increase this cycle. Caught between a rock and a hard place, the data-obsessed Fed cannot make up its collective mind if containing inflation or preventing more bank failures is the higher priority. The failure of Silicon Valley Bank (SVB) and Signature Bank of New York (SBNY) along with the near-failure of First Republic Bank (FRC) was due in large part to their irrational decisions to buy long-term government bonds and mortgage-backed securities during a period of all-time low interest rates. They obviously did not expect the FOMC to raise rates at the fastest and steepest pace in 40 years when making those bets. Remember that bond prices fall when interest rates rise and the longer the bond’s maturity, the greater the decline. These banks learned, too late, an expensive lesson in asset-liability management and the inverse relationship between bond prices and interest rates.

On March 12th the FDIC, Treasury Department, and the Federal Reserve agreed to guarantee all deposits of SVB & SBNY, and within hours the Federal Reserve Board announced the creation of the Bank Term Funding Program. The BTFP is a short-term lending vehicle for banks that may experience large withdrawal demands and is designed to offer an alternative to selling securities for losses. The BTFP will extend short-term loans to qualifying institutions and accept as collateral the very same bonds and mortgage-backed securities that sunk SVB & SBNY and wiped out most of FRC’s equity. The BTFP will value those securities at par instead of their actual discounted market value. These two emergency measures seem to have calmed choppy waters for the time being. However, every action has an equal and opposite reaction, and many questions remain unanswered and unknowable.

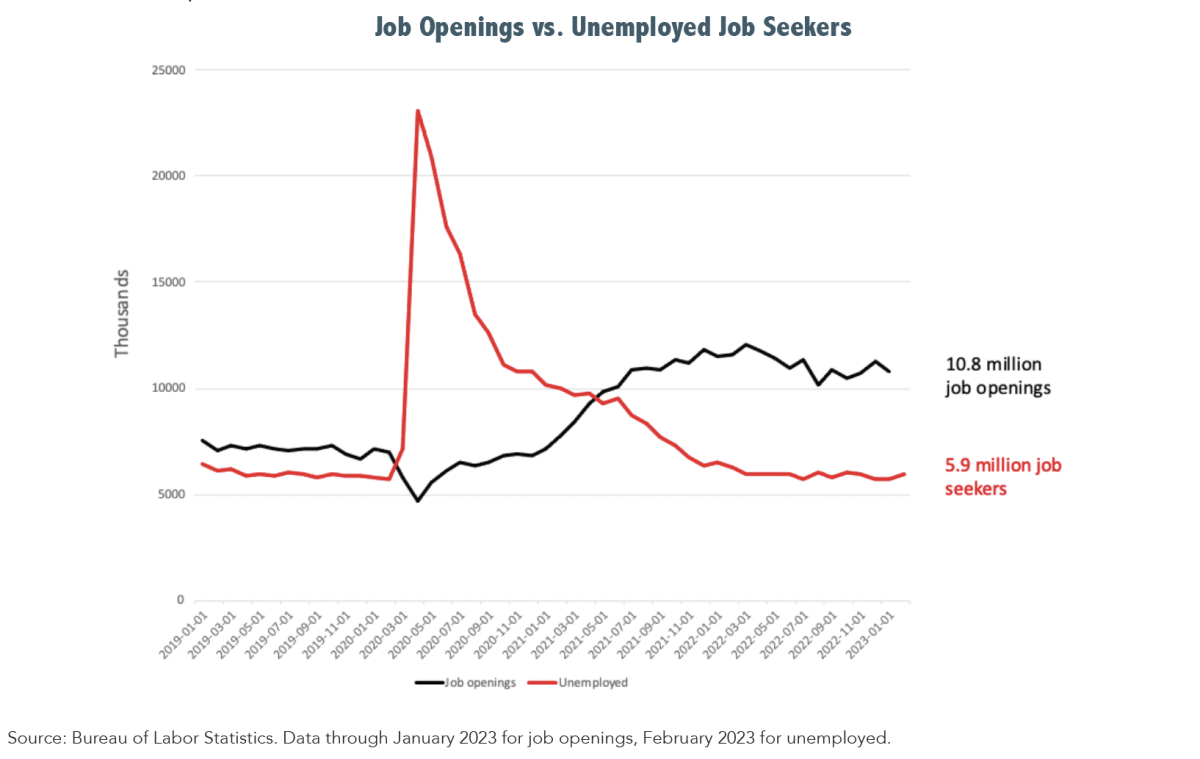

What impact will the banking crisis have on the overall economy? Many experts believe banks will now become more restrictive in their lending practices resulting in slower overall growth. Estimates by leading economists on the probability of a recession are wide-ranging, from low to almost certain, proving no one really knows. The Federal Reserve just lowered its 2023 GDP (Gross Domestic Product) forecast and predicts we will see flat to low growth this year, but no recession. Will the FOMC stay firm in its fight to tame inflation risking a recession or halt its rate hikes risking renewed inflation pressures? Given the fluidity of the banking crisis some thought the FOMC might take a pause to reassess things before raising rates at its most recent meeting. That did not happen, and some believe the Fed is trying to engineer a recession to break the back of inflation. If we enter a recession, will it be short or long, deep, or shallow? It is important to remember recessions are temporary interruptions in the economy’s and the equity market’s long-term permanent advance.

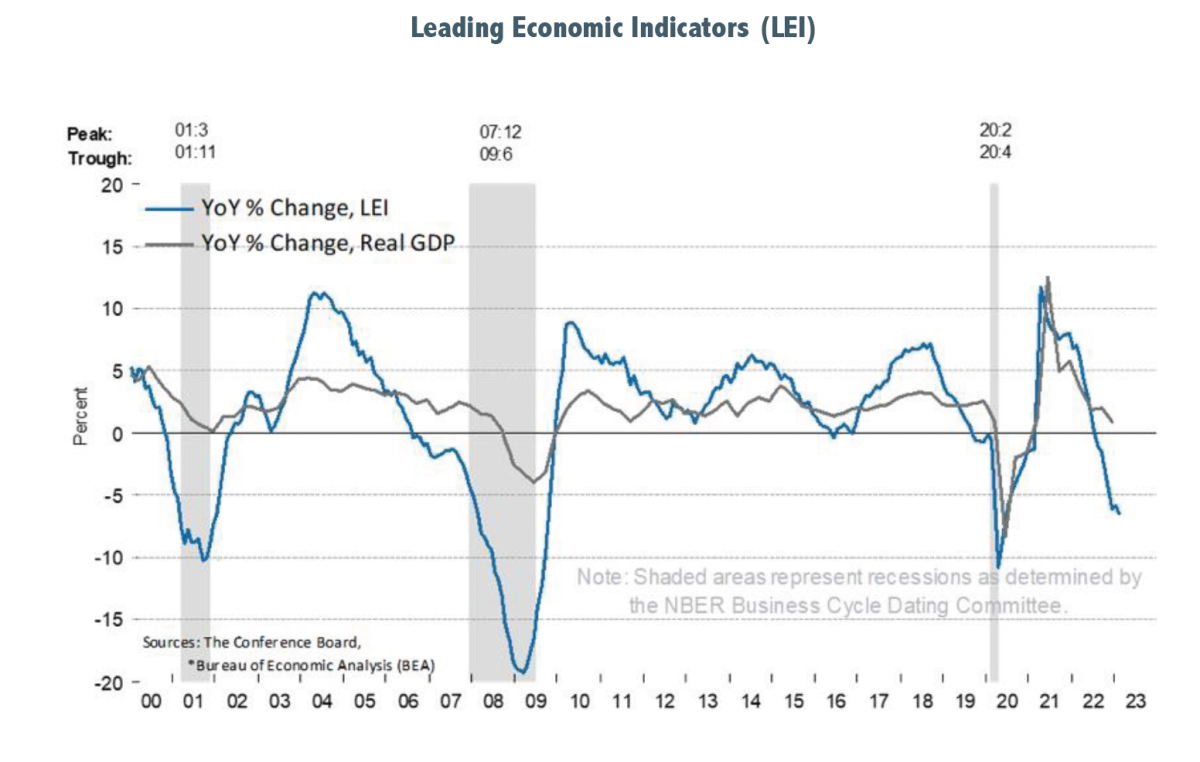

Bears point to the LEI (Index of Leading Economic Indicators) which has been falling for several months and the inverted yield curve with short-term rates above longer-term, both recession predictors. Additionally, declining home prices, cooling retail sales, and falling consumer sentiment point to a slowing economy. On the other hand, bulls argue that the Atlanta Fed’s 1Q-23 GDP estimate of 3.2%, strong net new job formation, reduced oil prices and moderating inflation argue against a recession. Since markets are forward-looking and usually bottom out before the end of a recession, investors are advised to avoid market-timing. Interest rates rose in Q1 concurrent with FOMC rate hikes and then plummeted in the wake of the banking crisis in a classic flight-to-safety reaction. The yield on the 10-year Treasury fell from 4.06% just before the crisis to a current yield of 3.47%. Rates on 2-year Treasuries dropped from 5.07% to 4.02% currently. The inverted yield-curve, historically a recession indicator, has flattened somewhat from about 100 basis points (1.00%) a few weeks ago to about 55 basis points (0.55%) now indicating investors believe the FOMC’s terminal target rate has dropped. Bond prices rose as interest rates fell resulting in positive total returns during the quarter of 1.82% and 1.74%, respectively from our two short-term bond benchmarks (Bloomberg 1-5 G/C & 1-5 Credit). Total return measures income received plus or minus price changes.

The creation of the BTFP by the Federal Reserve seems like an effective way to stave off more bank failures resulting from banks selling underwater securities to meet liquidity needs. Of course, it’s not perfect. If a bank’s withdrawal demands exceed the collateral on loan to the Federal Reserve, it might be forced to sell illiquid loans and other assets. The outcome of those asset sales could still have negative consequences. However, if successful, the BTFP may allow the FOMC to maintain a restrictive monetary position to combat inflation without inflicting more harm on banks. Time will tell.

For investors with broadly diversified, risk-appropriate portfolios, guided by calming advice from experienced professionals and an intelligent goals-based financial plan, the hot mess that is the crisis du jour should have minimal impact. Crises come and crises go, but the benefit of unemotional, detached objectivity is priceless. Markets are volatile in the short run and that volatility creates opportunity, also known as the equity risk premium, which is what investors earn from exposing their portfolios to uncertainty. Without volatility there would be no excess returns.

Stay the course.

Samuel J. Taylor, CIMA®, AIF®, CRPC®

Wealthview Capital, LLC