Three in a Row

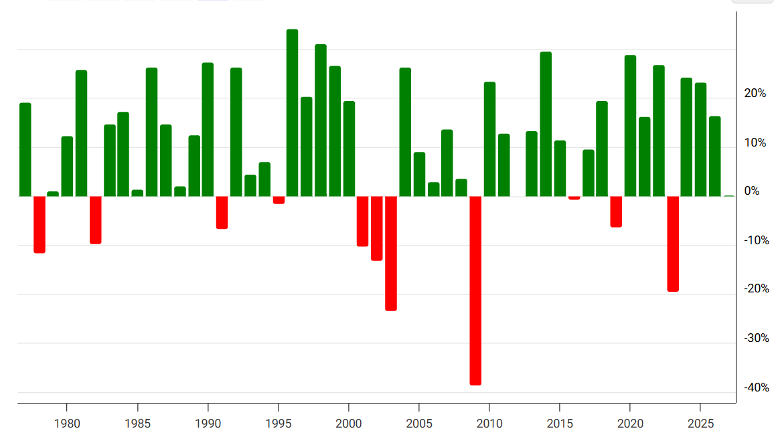

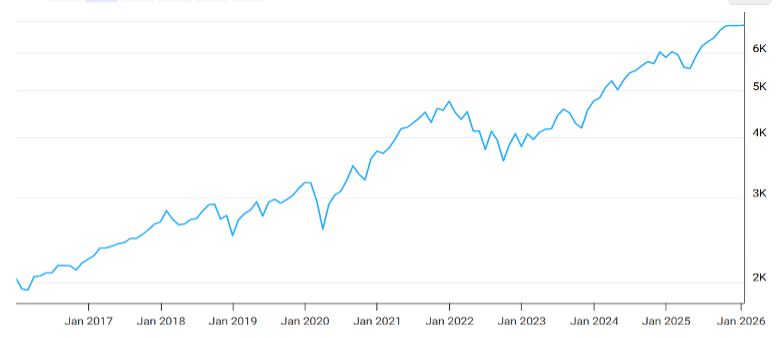

US equity markets surged to new highs in 2025, driven by massive AI investment fueling tech sector growth and robust corporate earnings, despite trade and political uncertainties. 2025 witnessed the third consecutive year of double-digit gains from the S&P 500, the most popular gauge of US equities, up 17.8% (including dividends) led by the technology sector and AI-related stocks. Developed international and emerging markets outperformed domestic equities for the first time in many years. Late-year concerns focused on elevated tech valuations, prompting some rotation into cyclical and defensive sectors, but overall optimism remained, continuing a strong bull market.

S&P 500 Annual Returns (1975 – 2025)

Source: Microtrends

The US economy grew an estimated 1.8% for the year, characterized by resilient consumer spending and the aforementioned significant AI-infrastructure capital outlays, despite volatility from tariff announcements and a government shutdown. Real (after inflation) GDP (Gross Domestic Product) growth was volatile throughout the year, with a strong rebound in Q2 and Q3 (reaching 3.8% and 4.3% annualized, respectively) after declining by -0.50% in Q1. Preliminary Q4 GDP numbers are pending but forecasters expect the US economy to slow, moving towards a more sustainable, but cooler, pace into 2026, with significant debate around the strength of the slowdown. Global GDP growth for 2025 was estimated at 2.5% to 3.0%, a deceleration from 2024 levels.

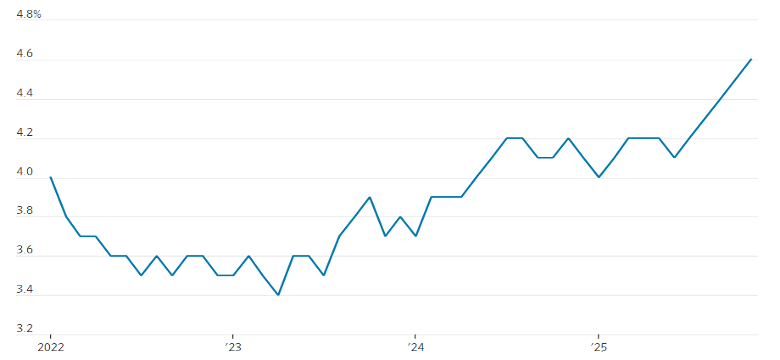

US inflation remained above the Federal Reserve's 2% target, with CPI (Consumer Price Index) inflation averaging 2.7% through November 2025. The Fed, facing a moderating labor market, resumed its easing cycle in the second half of the year with three consecutive cuts in the fed funds rate bringing the target range to 3.50% – 3.75% by year-end. The US labor market saw a broad-based moderation in hiring activity, with average monthly nonfarm payroll gains slowing significantly. The unemployment rate increased to 4.6% in November, the highest rate in four years, pointing to a loosening job market. Trade policy was a major driver of uncertainty and market volatility. An increase in average effective tariff rates to over 10% by August impacted global supply chains and contributed to elevated domestic prices, though the full pass-through to consumers was gradual.

US Unemployment Rate

Source: Wall Street Journal, Labor Department via St. Louis Fed (Seasonally Adjusted)

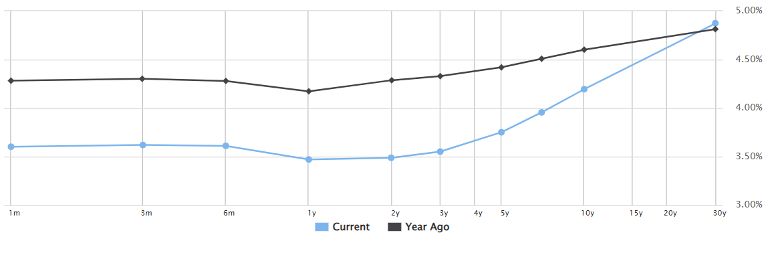

Fixed-income markets saw positive returns in 2025. Our short-term benchmarks (Bloomberg 1-5 Year Govt/Credit and Bloomberg 1-5 Year Credit) delivered total returns (income and price change) of 6.1% and 6.7%, respectively. As the year ended, expectations for further aggressive rate cuts in early 2026 were dampened by stronger labor market data and persistent inflation concerns with mixed outlooks. Some analysts foresee a steepening yield curve with shorter yields falling while longer yields face upward pressure.

The most significant events of 2025 included the April 2nd announcement of a sweeping "reciprocal tariff" regime, often referred to as the "Liberation Day" tariffs which caused an immediate crash. On April 3rd and 4th, US markets suffered their largest two-day loss in history, wiping out $6.6 trillion in value. The Nasdaq Composite fell nearly 6%, entering bear market territory. Contrary to traditional "safe haven" behavior, bond markets also saw widespread selling as yields spiked, a phenomenon described as "bond vigilantism" due to fading confidence in US fiscal policy. Markets rallied strongly starting April 9th after the administration announced a 90-day pause on tariff increases for most countries except China.

US Treasury Yield Curve

Source: Wall Street Journal

Artificial Intelligence remained a critical market driver, though the narrative shifted from pure euphoria to a restructuring of valuation based on actual productivity. The release of the low-cost Chinese AI model, DeepSeek R1, challenged the belief that leading AI required massive capital investment, causing NVIDIA to lose roughly $589 billion in market value in a single session. A report from MIT highlighted a "GenAI paradox," noting that while billions were being spent, 95% of generative AI pilots failed to deliver measurable profit, leading to further sharp technology selling in late August. Despite these corrections, the technology sector still ended the year as the top US performer, with Nasdaq up 20% for the year.

The US experienced its longest modern government shutdown, lasting 43 days starting October 1st. The shutdown stemmed from disputes over healthcare subsidies and foreign aid, leading to the furlough of 750,000 federal employees and caused intermittent volatility in government-linked sectors like defense and infrastructure. It also limited the availability of official economic data, complicating the Federal Reserve's policy decisions. 2025 saw a dramatic escalation in tensions between the White House and the Federal Reserve. President Trump publicly criticized Fed Chair Jerome Powell, calling for rates below 1% and planning an early nomination for a successor (the "shadow leadership" strategy) to undermine Powell's influence before his term ends in 2026. Effective December 1, 2025, the Federal Reserve officially ended its multi-year Quantitative Tightening (QT) program, stopping the active withdrawal of liquidity from the financial system.

Gold had its best year in decades, and silver prices more than doubled, according to Yahoo Finance. After a period of stagnation, global dealmaking surged in 2025 as political and rate clarity returned. Global deal value reached $3.8 trillion through the first three quarters, a 35% increase over 2024. Private credit continued to expand, accounting for nearly 20% of total deal financing. Global IPO activity saw a 39% increase in proceeds ($171.8 billion) compared to 2024, signaling a return of investor confidence in higher-quality offerings.

The economic landscape heading into 2026 is marked by a continued, albeit slower, expansion with significant dependence on AI-driven investment and the path of Federal Reserve policy. Policymakers face a challenge in balancing growth and inflation trade-offs. A "K-shaped" economic recovery was evident in 2025, with high-income consumers driving growth in services and luxury goods, while lower-income consumers showed signs of strain. The persistence of high tariffs and potential changes in immigration policy remain key sources of risk and uncertainty for labor supply, wages, and inflation. Additional risks include high equity valuations, geopolitical and regulatory risks, and the potential for an AI investment bubble.

S&P 500 (01/01/16 – 01/01/2026)

Source: Microtrends

What’s an investor to do? With so much conflicting information being disseminated instantly via the Internet, social media, financial journalism, etc. it is easy to become confused to the point of financial paralysis. We believe major market-moving influences cannot be predicted, and markets cannot be timed. Time in the market is much more important than timing the market. As such, we choose to participate, rather than anticipate, and believe that there is no substitute for a broadly diversified, low-cost, tax-efficient, risk-appropriate investment strategy. However, investing without a financial plan would be like building a house without a set of architectural plans. The result might not turn out well. One key to a successful financial journey is an intelligent financial plan that incorporates your life’s goals, resources available to fund those goals and an optimal long-term asset allocation policy that balances risk and return.

Best wishes for a safe and prosperous 2026.