Defying Gravity

The second quarter of 2025 began with a shock and ended with a bang. President Trump’s surprise April 2nd “Liberation Day” announcement of 10% (and more) global baseline tariffs on all trading partners initiated an immediate selloff in equities. Concerns abounded over everything from higher inflation, reduced earnings, stagflation, recession, Federal Reserve policy, and the impact on our global alliances. Additionally, geopolitical conflicts heated up during the quarter. After hitting an all-time high in 1Q-25, the S&P 500 touched an intra-day, bear market low on April 7, down -21.4%. Remarkably, by June 27 equity prices had fully recovered and ended the quarter at new all-time highs on improving trade relations, moderate inflation, and a belief the Federal Reserve will cut rates in the second half of the year. Shares of the world’s greatest companies simply refused to capitulate to negative gravitational pressures.

Trump’s April 2nd tariff announcement quickly escalated into an all-out trade war as many countries responded with reciprocal tariffs resulting in significant global trading disruptions. Trump initially hit China with a 20% tariff, then ultimately raised it to 145% in response to China’s refusal to retract their reciprocal tariffs. He later announced a 90-day pause on reciprocal tariffs above the 10% baseline (excluding China) if countries were willing to negotiate better terms with the U.S. That announcement served as a jolt of optimism, propelling the S&P 500 to its third-largest single-day gain since World War II.

Overall sentiment started to improve with the delays in tariff implementation, supported by evidence that countries were willing to negotiate a change in their tariff policies toward the United States. Many companies did not wait for the outcome from the 90-day pause and expanded orders for imports to get ahead of possibly more punitive tariffs. However, baseline 10% or greater tariffs will not be borne without costs, yet to be determined. The answer will be revealed over the coming months with the release of economic data.

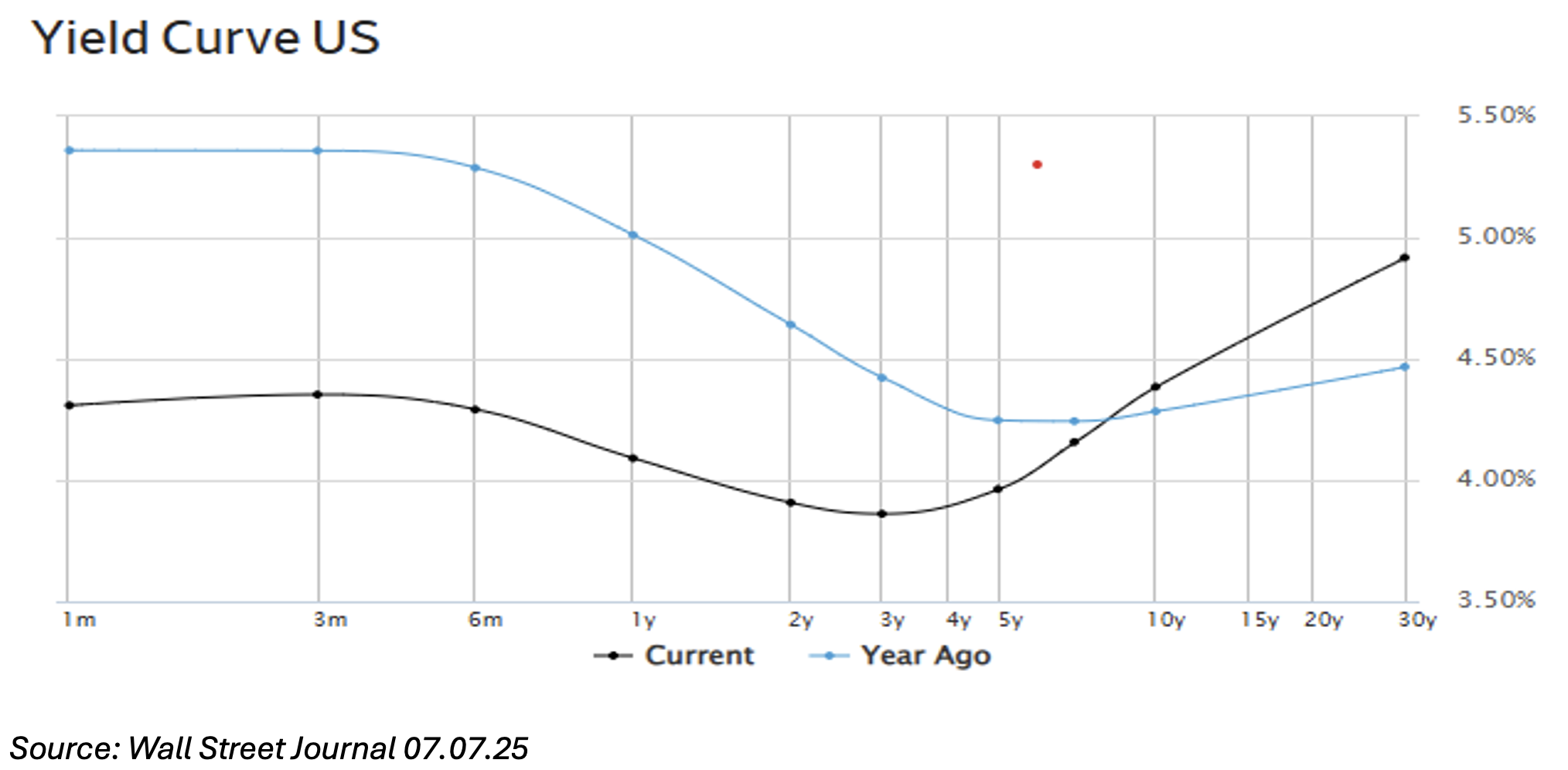

The FOMC (Federal Open Market Committee) met twice in 2Q-25 and voted both times to continue its wait-and-see posture, holding off on lowering the fed funds rate. In May, the Fed stated it is in a wait-and-see mode because there is so much uncertainty around the new administration's policies and their effect on the economy. In June, it softened slightly, stating that uncertainty about the economic outlook has diminished but remains elevated. “Although swings in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate remains low, labor market conditions remain solid, but inflation remains somewhat elevated,” the Fed commented. President Trump continues to criticize Chairman Powell for his reluctance to lower short-term interest rates, believing there is ample evidence that inflation is moderating, and lower rates will extend the growth of our economy.

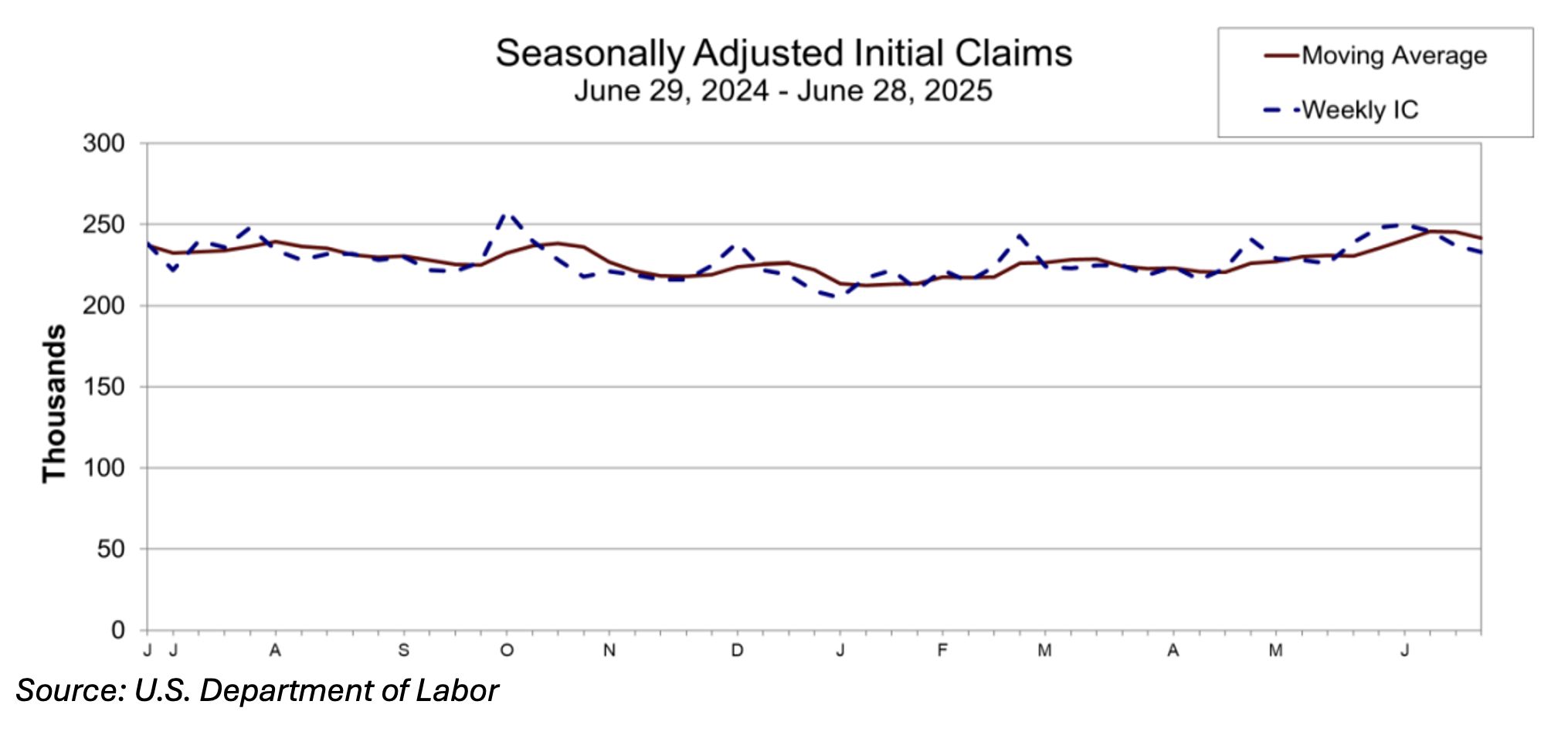

The labor market is an important area that the Federal Reserve analyzes when assessing the health of the overall economy. The latest jobs data, which was released slightly after 2Q ended, showed an increase of 147,000 in non-farm payrolls, above consensus estimates. The unemployment rate was 4.1% in June and has remained in a narrow range from 4.0% to 4.2% since May 2024, a range many economists believe represents full employment. The monthly unemployment rate (lagging indicator) and weekly initial jobless claims (leading indicator) are two numbers the Fed watches closely. Because consumer spending accounts for about 70% of our GDP (Gross Domestic Product), increases in initial jobless claims can reduce consumer spending.

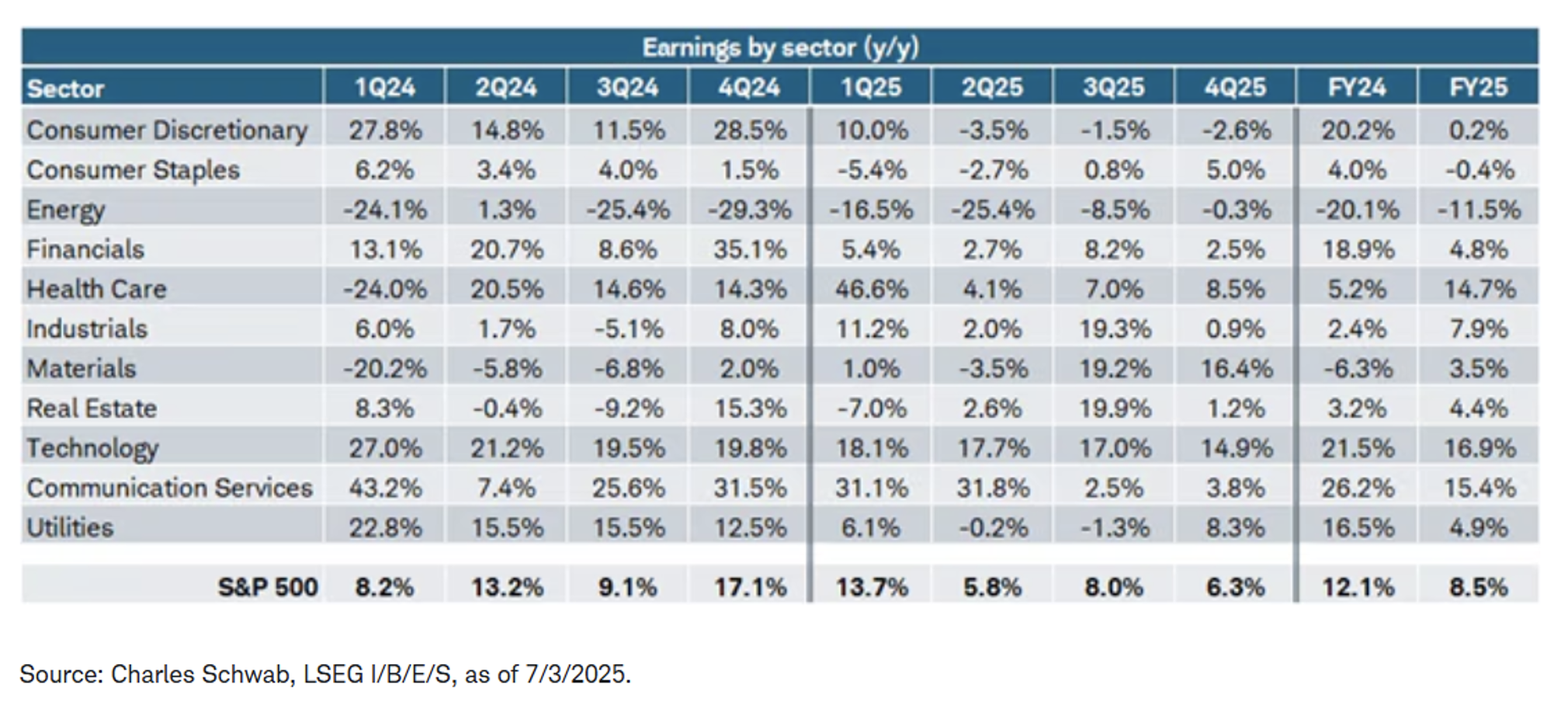

Equity valuations remain elevated and above 10-year averages. Calendar-year 2025 earnings growth estimates are currently 8.5% compared with 12.1% in 2024. However, many of those estimates depend on unpredictable variables such as the impact of tariffs. If companies experience sustained higher costs from tariffs they will be forced to raise prices and/or cut expenses to avoid lower earnings. Earnings drive the equity market and if earnings estimates are robust, then prices tend to follow. When earnings estimates are falling that can pull prices down or put a lid on price gains until earnings catch up.

Risks abound as always. The federal debt is approaching $37 trillion and on May 16, Moody’s Investor Service joined S&P Global & Fitch in lowering the U.S. sovereign debt rating, citing rising interest costs, unsustainable fiscal trajectory, and political dysfunction. The Big Beautiful Bill signed into law after the close of the quarter is projected to add to the nation’s debt unless growth exceeds current forecasts. Geopolitical risks include Russia’s continued defiance of Trump’s attempts to negotiate peace with Ukraine. Israel bombed Iran on June 13, but rather than falling, equities went up. This was because the market believes a nuclear-armed Iran is not in the world’s best interest.

The market is fickle and its movements thus far in 2025 have been dizzying, up one day, down the next. How can momentum move from bullishness to bearishness and back to bullishness in such a short period of time? It’s because the market is driven by investor sentiment, and investors have been on an emotional rollercoaster this year. Anyone trying to time the market to avoid temporary declines can quickly wind up on the wrong side, finding it difficult to recover. Wealthview believes the opportunity for wealth creation through ownership in a collection of the world’s greatest companies is too important to put at risk by ever trying to time the market. Companies are innovative and resilient with a history of successfully navigating the crisis de jour and defying its gravitational forces. It would be prudent to trust in their ability to continue doing that.

Enjoy the summer,

Sam Taylor, CIMA℠, AIF®, CRPC℠